Leveraged ETF Allocation Formula (LEAF)

Introducing "LEAF" (Leveraged ETF Allocation Formula), a groundbreaking rules-based investment strategy designed to optimize your portfolio. With over 45 years of experience in managing private client investments for Canadians, we've observed that while passive index-based investments often outperform active strategies, they still rely on satisfactory index performance. LEAF aims to improve on long-term index returns by significantly reducing the magnitude of portfolio drawdowns.

Leveraged ETF Allocation Fund. Phase 1. Proof of Concept

Why LEAF? – Seeking Superior Returns Through Defensive Investing

“Risk mitigation should raise your returns" – Mark Spitznagel, Universa Investments

Investment Objectives:

-

To generate returns greater than the S&P500 over a 2-5 year period through superior downside capture.

-

To experience lower drawdowns during periods where the S&P 500 corrects by greater than 20%

Investment Philosophy:

-

Predicting the short to medium term direction of the underlying components of the strategy is difficult and not required for success

-

The performance drag that accompanies portfolio diversifiers can be overcome through leverage.

Attempting to fully participate in equity upside while protecting against outsized losses leads to significant long term outperformance due to the nature of compounding. (33% loss needs a 50% gain to break even, 50% needs 100% etc)

-

Applying leverage to a hedged portfolio seeking to outperform the S&P 500, without increasing drawdowns, is possible through the holding of "risk off" ETFs if correlations between the ETF holdings stay within their historical range over time

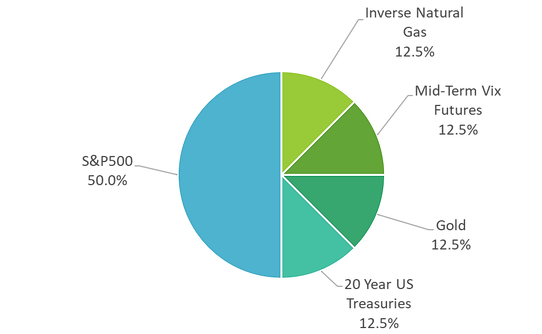

Risk parity strategy

50% of targeted volatility comes from the S&P500 and 50% comes from 4 defensive ETFs. We will show in future posts how this can be significantly improved on. This is just a simple example.

Portfolio Construction

Total exposure has historically varied between 2.30x and 2.53x depending on trailing volatility levels of the 5 ETFs. Leverage of the underlying ETFs vary from 1x-3x daily.

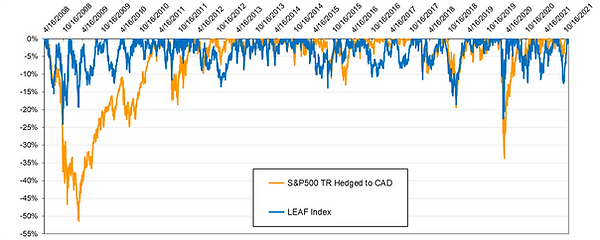

Starting April 17, 2008. Limited by the availability of natural gas futures price history

When leveraged ETF price history was not available, we simulated historical performance based off 1x indexes and ETFs.

All ETFs/stocks are purchased in USD but priced back to CAD for an additional hedge

(purchasers of the strategy recognizing returns in CAD)

Positions are rebalanced at a predetermined deviation from their target weight. Historically this has been every 17.3 trading days on average.

Index Statistics

For the period April 17, 2008 to November 22, 2021

Log Growth Performance History

Drawdown History

Rolling 6 Month Returns

Coming soon,

Phase 2. Enhancing returns and risk mitigation through additional Risk Off strategies

Phase 3. Harnessing reversion through smarter rebalancing.